Dollar languishes around lows amid Democrat blue wave

Written by Matthew Ryan, Senior Market Analyst Ebury

Amid the chaotic scenes in the US capitol on Wednesday, the main impact on the FX market came from the results of the two run-off Senate elections in Georgia.

urrency traders were largely unphased by yesterday’s pro-Trump attack on the US capitol building, which delayed the official confirmation of Joe Biden’s presidential election victory. Following the results of the runoff elections in Georgia, Biden’s Democratic Party will now have majority control of both the US House and the Senate for the first time since 2009, a so-called ‘blue wave’ in Congress. As we noted yesterday, the implication for the markets is that Biden will now likely have a much easier task in forcing through legislative changes during his first two years as president. FX traders have subsequently continued to sell the dollar as they price in both larger fiscal spending from the Biden administration, with the greenback now languishing around multi-year lows versus the euro.

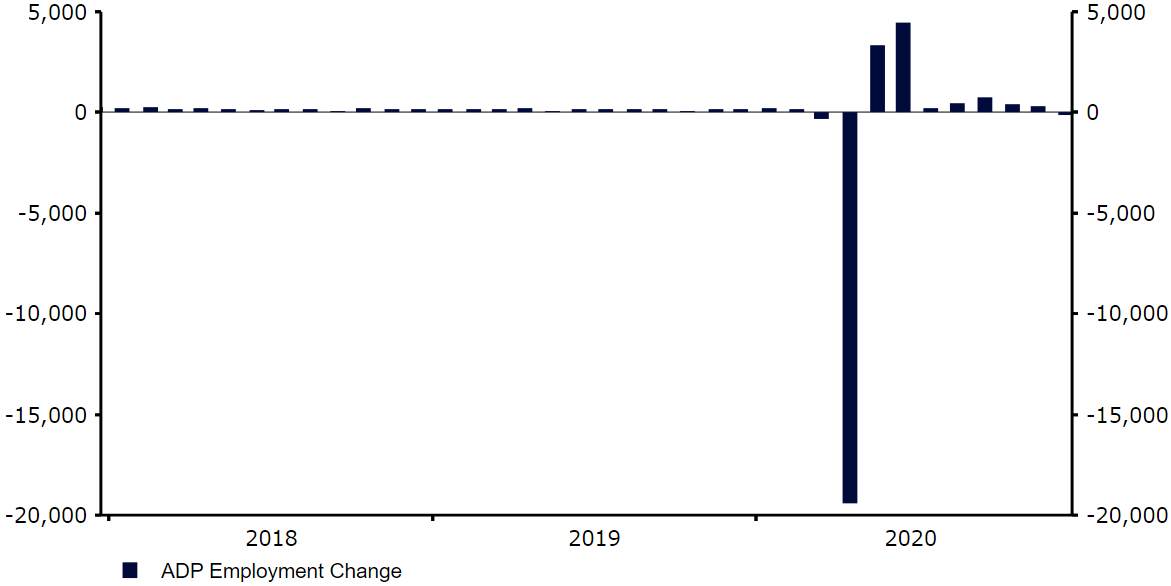

On the macroeconomic front, Wednesday’s ADP employment change number painted a worrisome picture about the current state of the US labour market. The measure showed a net contraction of jobs in the private sector of 123,000 in December (well below the +88k consensus), the first time that jobs have been shed since the peak of the COVID crisis in April. Last night’s FOMC meeting minutes also continued to strike a dovish tone, with some members seeing the potential need for an adjustment in the pace of future asset purchases.

Figure 1: US ADP Employment Change (2018 – 2020)

Source: Refinitiv Datastream Date: 07/01/2021

News headlines out of the US today will likely continue to be dominated by yesterday’s incident in the Capitol, although currency traders will probably be more interested in Friday’s payrolls report for December.

Euro Area set for Q4 contraction, UK virus deaths rise to April highs

The euro was largely unperturbed by yesterday’s downwardly revised PMI numbers out of the common bloc, which continued to suggest that the Euro Area economy contracted in the final quarter of 2020. Both the manufacturing and services indices were revised lower from the initial estimates, dragging the composite index into a deeper contractionary 49.1. While there is a general resignation in the market that a contraction in activity in Q4 is almost nailed on, hopes of a mass vaccine rollout and the recent stabilisation in virus caseloads in Europe have raised optimism regarding the near-term outlook in 2021.

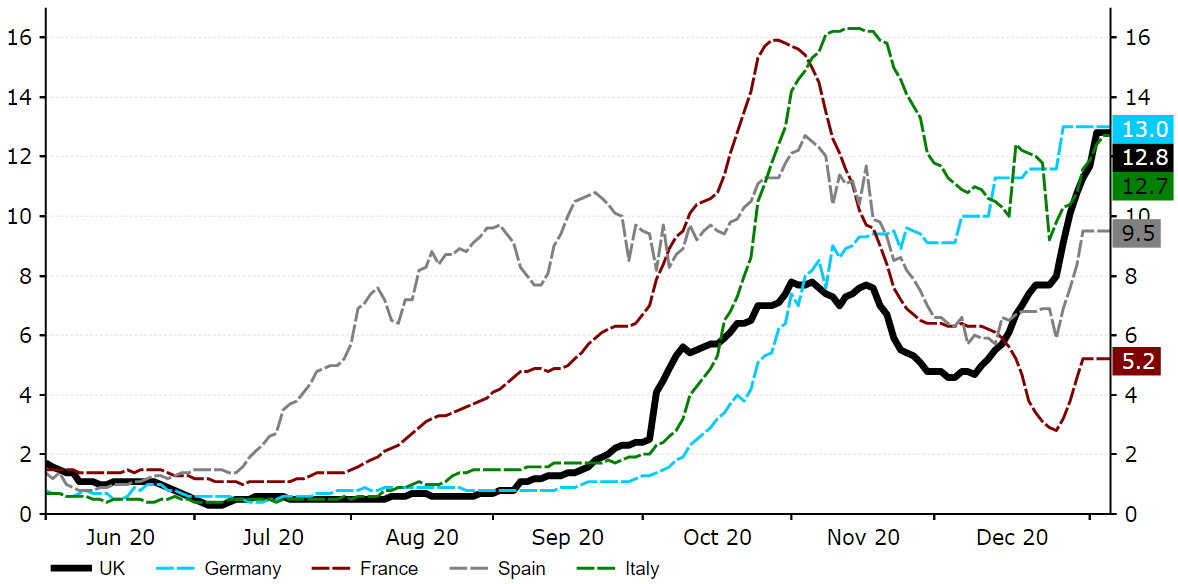

The same cannot quite be said for the UK, which looks set for another period of economic hardship and a possible double-dip recession following the reimposition of national lockdowns earlier this week. New deaths caused by the virus came in above 1,000 yesterday for the first time since April, with cases also hitting fresh highs above 60,000. The UK’s test positive rate have also continued to climb, although we note that it is now at a very similar level to that of Italy and updated data out of Germany (around 13%). The pound continues to trade largely unflustered, although as mentioned on Wednesday this may not remain the case should both caseloads and virus deaths persist on their current trajectory, with the situation expected to get worse before it gets better.

Figure 2: UK vs. Euro Area COVID-19 Test Positive Rate (2020 – 2021)

Source: Refinitiv Datastream Date: 07/01/2021

Press Contact :

Gunther De Backer